|

Getting your Trinity Audio player ready...

|

Cyber insurance is essential for businesses facing rising cyber risks like hacking and data leaks in 2025. With premiums dropping due to market trends, it’s the ideal time to invest in protection.

Table of Contents

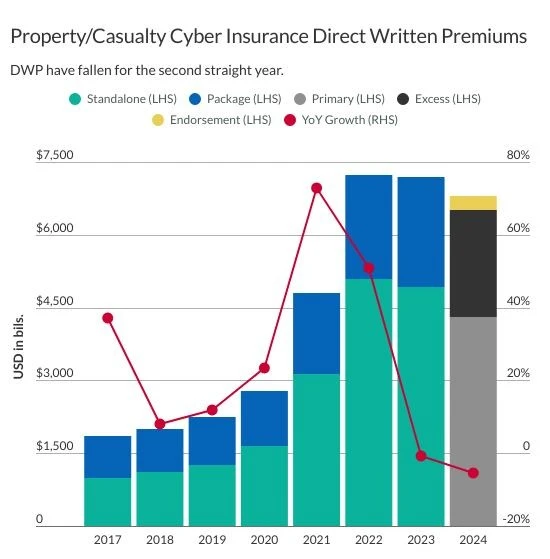

The landscape of cyber insurance is shifting as underwriters see steady gains, yet face a shrinking pool of revenue due to heightened competition and waning interest from businesses. This has resulted in a consistent drop in premium earnings for three consecutive years—a trend that could benefit companies seeking affordable protection. Industry analysts predict that premium prices will keep falling through 2025 before stabilizing, as market forces find equilibrium. According to insights from Fitch Ratings, a financial analysis group, renewal costs for cyber policies have decreased over the past three quarters, with expectations of this pattern holding steady. As organizations hunt for competitive pricing or pause to reevaluate their needs, insurers are trimming rates by small but noticeable percentages, notes Gerry Glombicki, a senior analyst at Fitch Ratings.

“Cyber insurance has long been a lucrative field for providers, even amidst major disruptions like the 2017 WannaCry and NotPetya attacks,” Glombicki explains. “But with fewer policies sold annually and downward pressure on pricing, insurers are adjusting by scaling back some of their historically high margins.”

Related: 6 Top Future Jobs

The cyber-insurance sector operates in cycles, with periods of rapid expansion followed by stabilization. The spike in ransomware during the pandemic years triggered a massive 160% growth in policy underwriting from 2020 to 2022. This boom, however, brought a wave of claims and elevated loss ratios—peaking near 70% in 2020 and 2021, compared to a more typical 40% before and after those years. (Loss ratio refers to the proportion of premium income paid out as claims.)

Lessons from High Costs and Rising Risks

The insurance industry, alongside many policyholders, endured tough lessons during this volatile period, according to Maria Long, a top executive at Resilience, a firm specializing in cyber insurance and support services. “During the height of ransomware attacks, many companies lacked strong defenses, leading to heavy financial hits,” she recalls. “With such dismal outcomes and unavoidable high loss ratios, premium costs skyrocketed—some businesses faced rate hikes as steep as 400%.”

Despite a modest dip in 2024 cyber-insurance premiums—down 5.4% from the prior year, per Fitch Ratings—the industry’s outlook remains optimistic. Though U.S. premium revenue fell slightly to roughly 6.9 billion and policy numbers dropped 26.9 billion and policy numbers dropped 232 billion by 2030, up from $16 billion in 2025. Companies are responding to these lower rates in varied ways, says Shawn Ram, a senior officer at Coalition, a cyber-insurance provider.

“Some larger firms are capitalizing on reduced costs by securing higher coverage limits—think 20 million dollars to 100 million dollars or more,” Ram observes. “Meanwhile, others, grappling with tight budgets, are redirecting savings to core business needs instead of expanding coverage.”

Cyber Insurance Beyond Financial Payouts

Cyber insurance offers value far beyond claim settlements. Prior to any incident, insurers or their security partners often evaluate a company’s defenses, providing actionable advice to bolster protection. Certain tools and technologies can even lower policy costs for businesses. After a breach, insurers typically offer a clear recovery roadmap and access to trusted vendors and experts. “This is where cyber insurance truly shines,” Glombicki of Fitch Ratings points out, though he laments that “many fail to recognize or communicate this added value to clients.”

Related: How AI capture the world market cap

While some organizations might opt for the cheapest premium, a wiser strategy is to weigh the support services provided before and after a cyber event. If budget constraints arise, companies might consider lowering coverage limits rather than dropping policies entirely to maintain access to these critical benefits, suggests Resilience’s Long.

“If you’re uninsured during a cyber crisis, you’re on the hook for every cent of the damage,” Long warns. “Plus, you miss out on expert response teams, legal guidance for compliance, and specialized firms ready to expel threats from your systems and help you recover swiftly.”